Finally, Congress is moving to overhaul the IRS, and let’s hope that it is in the right direction. If you’re like me, some of you might be saying “It’s about time!” or “Better late than never,” right? But before I go into more detail about the approved IRS changes, I will first tell you from an accountant’s perspective how difficult it has been to deal with the IRS over my career. Most of what I am going to tell you is true, perhaps with a little exaggeration to emphasize the frustration that we go thru when we go to bat for our clients.

When the IRS contacts you, it is almost always via snail mail correspondence. Rarely, would you ever receive a telephone call from the IRS. If you do, it’s probably a scam of some kind. We always tell our clients to send us the actual IRS letter they received. (Note: a photo of the correspondence with your smart phone camera is harder to read than the eye chart at your optometrist’s office.) Once we receive your letter, we will determine whether we can address the issue simply by sending a reply with support for our position. However, there are some instances where we deem that a call to the IRS is more appropriate.

To begin, we must first file a power of attorney (POA) so we may speak to the IRS on your behalf. You must sign a Form 2848, which tells the IRS that we are acting on your behalf and are authorized to discuss your tax issue(s). We then fax the POA to the IRS. Within a few days, the POA is entered into the IRS database and we are now ready for the “fun” to begin!

Did I say fun? What I really mean to say is: “let the accountant’s torture begin!” First off is the myriad phone prompts to get thru before you can even arrive at the proper wait queue. You will be asked what language do you want? I almost always go with “English,” but Spanish is also a good choice if you think you can get to a representative quicker. I’ve often wondered why Portuguese is not a choice. The irony is that “English” is usually not the first language of the IRS agent on the other end of the phone. Good luck!

The next series of automated prompts asks what kind of tax return we are calling about. To be honest, my motivation is just to get thru to any human on the other end of the line. I’ve rarely found that the IRS agents are well versed in any of the tax areas you might choose.

OK, so now we have hit the 5-minute mark on the call and we haven’t even reached a live person yet. The next series of questions asks: Are you calling about a refund, calling about a balance due and want to make a payment or don’t know why you are calling? The quick answers are: Refund – “Call back tomorrow,” Balance Due – “An agent will be with you very shortly” and Don’t Know – “Be prepared to wait a long time.”

Most of our situations fall into the latter category. And waiting a “long time” is putting it mildly. This is where you want to make sure that your accountant can multitask and work on a different client during the wait time! I must admit, listening to the IRS on-hold music is worse than what you hear piped in at your dentist’s office. At least at the dentist’s office, you can skip the Novocain and get out of there quicker. Not the case with the IRS. You get an endless loop of audio distress – in fact, I can hear it playing in my mind right now!

So how long does this go on for? Quite honestly, you could easily be on hold for an hour. Once you get through to somebody, you could spend another 10 minutes or so with the IRS agent quizzing you on the POA you sent in, just to make sure it’s really you. If you pass this test, you finally get to describe your client’s tax issues and positions to the agent. Good luck on that! The agent will likely struggle to understand your comments and put you on hold several more times during the call to freshen up a bit. One thing you need to be lucky about is not catching an agent at the end of his or her shift. This happened to me on my last IRS call when the agent told me he had to end the call because he was not authorized to work overtime and I would have to start over again with a new agent. Yes, I am not making this up! I went right back in the wait queue and spent another 45 minutes on the phone on top of the first hour I wasted. If you were this client, I promise I didn’t charge you for the first hour!

Are accountants frustrated with the IRS? You bet we are. We can only hope that the new IRS reform Bill will have a positive impact on the agency’s performance.

Now, let’s examine some of the highlights of the Taxpayer First Act, H.R. 3151:

Customer Service Strategy – The Bill requires the IRS to develop a comprehensive customer service strategy and to submit this plan to Congress within one year. What does this mean? The IRS must provide better assistance to taxpayers, determine what services can be outsourced, improve IRS customer service, update guidance and training materials for IRS agents and identify benchmarks to measure progress in implementing the new strategy.

Independent Office of Appeals – A new Chief of Appeals position will be created, and he or she will be charged with resolving federal tax controversies without litigation on the basis that he/she “(A) is fair and impartial to both the Government and the taxpayer, (B) promotes consistent application and interpretation of, and voluntary compliance with, the Federal tax laws, and (C) enhances public confidence in the integrity and efficiency” of the IRS.

IRS Organization – The Treasury secretary must submit a plan to Congress to ensure implementation of the priorities specified by Congress in the Bill, prioritize taxpayer services, streamline the agency’s structure, and position the IRS to fight cybersecurity threats.

Miscellaneous Provisions – In no order of importance:

- The innocent spouse relief provisions are amended to allow review by the Tax Court along with other changes that limit equitable relief.

- The Bill limits the type of tax receivables that can be assigned to private debt collection services.

- Requires the IRS to create a single point of contact for tax-related identity theft victims and the IRS will notify taxpayers if it suspects they are victims of identity theft.

- Directs the IRS to create an online platform to allow taxpayers to prepare and file Forms 1099.

- Increases the failure-to-file penalty for income tax returns where no tax is due to $330.

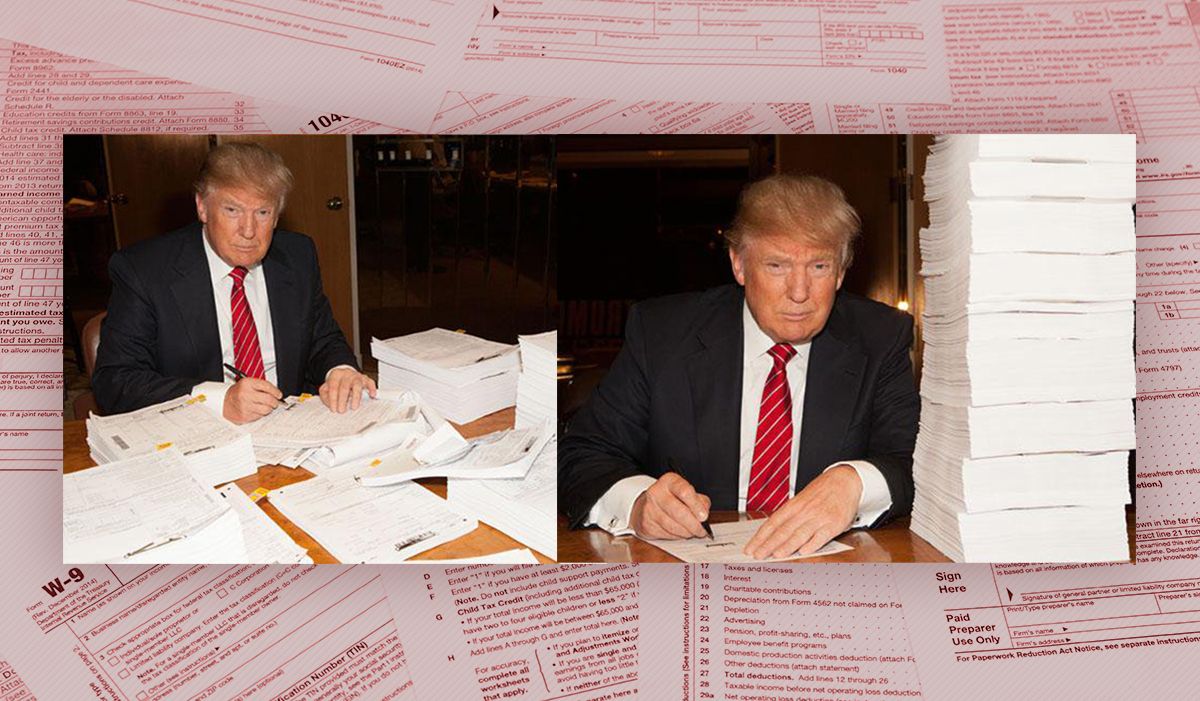

What happens next? It’s simple, President Trump must sign the Bill and it becomes law. If you recall, President Trump may have one of the longest running IRS audits of his tax returns going on in the history of IRS audits. This is presumably why he is the first U.S. President since Nixon not to release his tax returns to the public (which I am certain would show that he has made more money, paid more taxes and donated more to charity than any other president in the history of all U.S. Presidents). Tomorrow morning when you wake up, be sure to check your Twitter feed. You may find that President Trump has tweeted he has now created the most “fantastic” IRS agency of all time! Let’s keep our fingers crossed!

**BREAKING NEWS! TRUMP SIGNED THE TAXPAYER FIRST ACT INTO LAW ON MONDAY, JULY 1ST.**