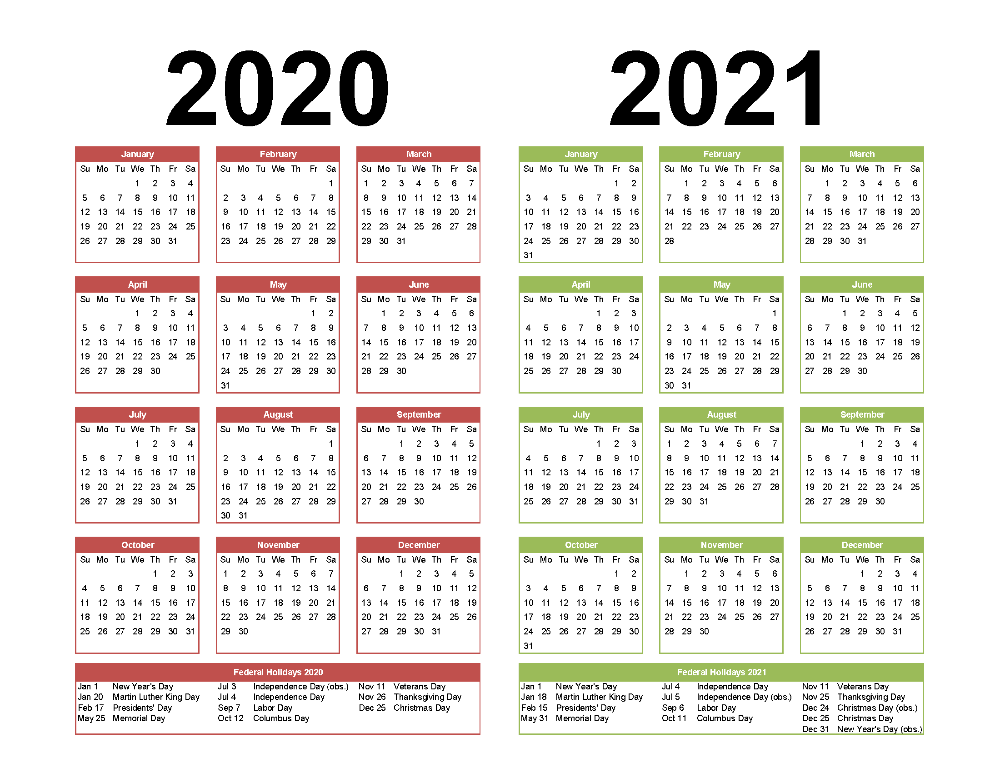

Many of you have secured Paycheck Protection Program (PPP) loans under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) administered by the U.S. Small Business Administration (SBA). The purpose of these loans is to fund payroll and other eligible costs such as payroll taxes, interest on a mortgage obligation, rent and utility costs for businesses adversely affected by the COVID-19 pandemic. Any individual or entity receiving a PPP loan is eligible for full forgiveness of the principal balance, provided that the loan proceeds are expended for the enumerated eligible costs during the covered period (February 15, 2020 thru December 31, 2020).

The CARES Act provides that any amount that would normally be included in gross income as a result of forgiveness of the PPP loan, shall be excluded from gross income. Back in May 2020, the IRS released a Notice stating that no tax deduction would be allowed for an eligible expense that is otherwise deductible if the payment of that expense results in forgiveness of a covered loan. So what does this all mean in plain English: You don’t have to pick up the PPP loan that is forgiven by the SBA as income, but you also don’t get to deduct the expenses that you used the PPP loan proceeds to cover.

Flash forward to today. Many of you either have or are just getting ready to submit your PPP loan for a grant of forgiveness. So, what happens if you do not find out whether your PPP loan is forgiven by the end of the year? Well, the IRS recently issued guidance on this very question. In Rev. Rul. 2020-27 & Rev. Proc. 2020-51, the IRS stated that if a taxpayer reasonably expects to receive forgiveness of the covered loan on the basis of the expenses it paid or accrued during the covered period, even if the taxpayer has not submitted an application for forgiveness of the covered loan by the end of such taxable year (or the forgiveness application is still in process), then the taxpayer may not deduct those expenses in the taxable year in which the expenses were paid or incurred.

In other words, for year-end tax planning purposes, it is imperative that you add back to taxable income (i.e., do not deduct) any eligible expenses used to obtain forgiveness of your PPP loan.

Despite the above IRS position, there are several “safe harbors” available that would allow a taxpayer to deduct the otherwise non-deductible expenses. These “safe harbors” would involve situations where, in a subsequent year, the lender notifies the taxpayer that forgiveness of all or part of the covered loan is denied or the taxpayer irrevocably decides not to seek forgiveness for some or all of the covered loan. A statement containing specific information would have to be attached to a tax return in which the non-deductible eligible expenses are being deducted.

Please have a thorough discussion of this topic with your tax professional. The tax consequences of the IRS’s latest guidance are likely to have a major impact on your 2020 tax returns. While it is possible that Congress may act to change these results (the intent of the PPP was not to create a taxable event upon forgiveness), it is unlikely to happen during the remainder of this year. For this reason, it may make more sense to delay filing your 2020 tax returns and file extensions. CTM is always available to guide you through these complicated rules. Contact us at (847) 444-1040.