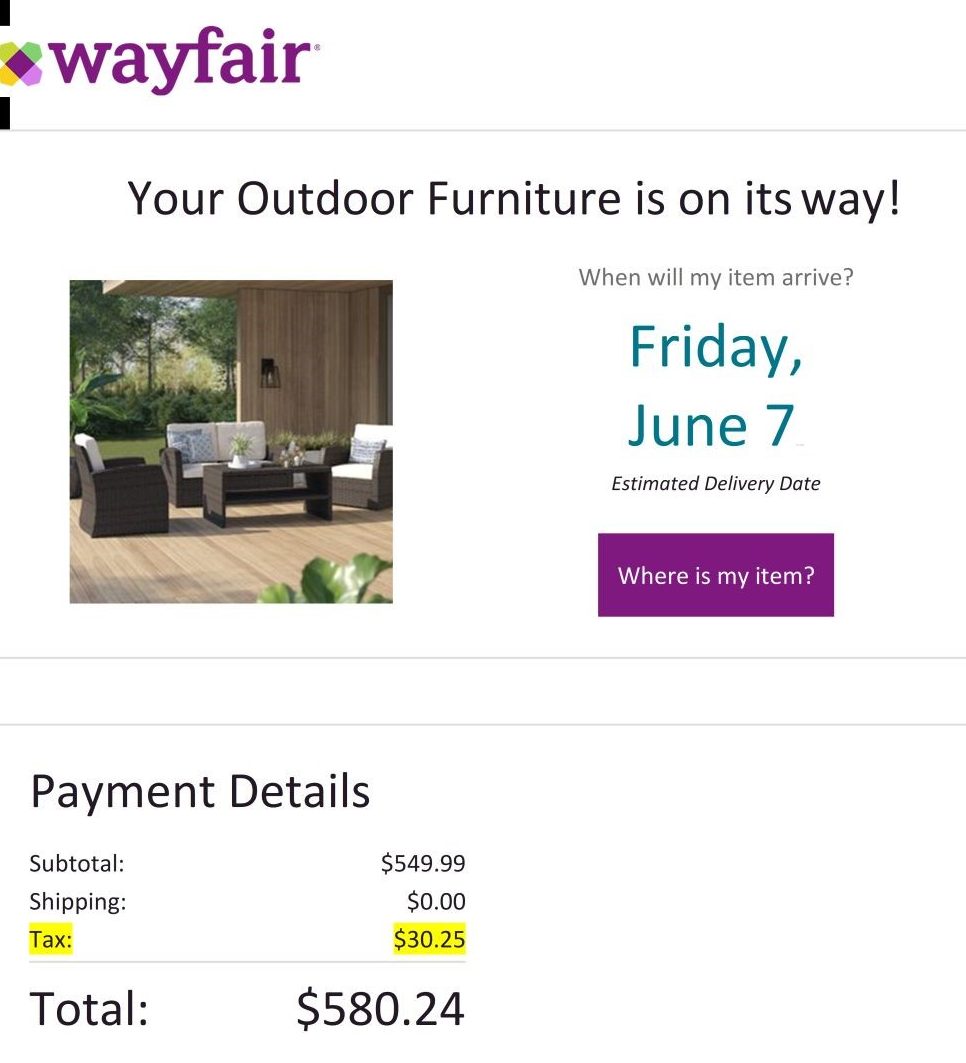

Last June, my wife told me we needed a new outdoor patio chair. I tried to put it off another year, but how many excuses can one come up with? Well, what easier way to find a new chair than to shop on Wayfair.com, a mega Internet retailer known for selling a multitude of household items delivered right to your front door. I perused the website and eventually settled on a brown wicker chair for $549.99. I went to “checkout” and when I arrived at the final screen, I noticed that I was being charged $30.25 in “sales tax” – on an Internet purchase. This was unexpected. I didn’t remember having to pay a sales tax before. I guess I should have listened to my wife and purchased this chair when she first asked.

So, what changed? On June 21, 2018, the Supreme Court issued its decision in South Dakota v. Wayfair. Essentially, this decision turned the sales tax world upside down. Retailers in the home goods, furniture, clothing, jewelry and electronics industries such as Wayfair Inc., Overstock.com or Newegg Inc. (the named defendants in this case) now have greater exposure to charge and collect sales tax on internet sales.

The key criteria in determining whether a retailer must collect sales tax in any particular state is known as nexus. Tax nexus is defined as the level of contact a business must have within a jurisdiction before the jurisdiction can subject the business to tax. Prior to the Wayfair decision, there were two well-known Supreme Court cases that generally controlled the sales tax nexus area:

- National Bellas Hess, Inc. v. Department of Revenue of Ill. – In 1967, the Supreme Court heard an appeal of an Illinois case in which the court ruled that a mail-order company with no connection to customers in Illinois other than through the mail lacked the minimum contacts with the state that the Due Process and Commerce clauses of the U.S. constitution require to impose taxes. The court held that a state could only require a retailer to collect sales tax only if the retailer maintained a physical presence in the state, such as by having a retail outlet, sales personnel or property within the state.

- Quill Corp v. North Dakota – In 1992, the Supreme Court looked at the nexus requirement established in the Bellas Hess case once again by considering another case involving a mail-order seller. In this case, the Supreme Court reversed its earlier position regarding Due Process, but it upheld the Commerce Clause ruling that prohibits state taxes on activities that lack a “substantial nexus” with the state.

Over the last decade, Internet sales have skyrocketed. In 2018, online retail sales were estimated to be over $517 billion and accounted for almost 14% of total U.S. retail sales. Think about how much these sales escaped state taxation due to the nexus test established by old case law. Brick-and-mortar retailers suffered as a result of being in a competitive disadvantage with respect to sales tax.

One thing to note is that while many sellers were not required to charge and collect sales tax on Internet sales, that didn’t exempt the consumer from having pay “use” tax. You may not have noticed, but there’s a question on your state income tax return about “whether you purchased any retail goods for which you did not pay sales tax during the year.” If you did make such purchases, the tax return asks that you report the dollar amount of such purchases and pay “use” tax on these purchases, typically at a tax rate of 6%. In all my years of practice, I have only had one client who indicated that he or she made such purchases during the year (and paid a small amount of use tax on those purchases)!

The Wayfair decision changed much of the sales tax rules and practice that I have just described. Let’s examine the new sales tax landscape. In Wayfair, the Supreme Court held that nexus is established when the taxpayer “avails itself of the substantial privilege of carrying on business” in the jurisdiction. This particular case dealt with the state of South Dakota. In particular, South Dakota’s law stated that a retailer would be liable for the collection of sales tax – even if the seller does not have a physical presence in the state – if the seller meets either of the following criteria in the previous or current tax year:

- The seller’s gross revenue from the sale of tangible personal property, any product transferred electronically or services in South Dakota exceeds $100,000; or

- The seller sold tangible personal property, any product transferred electronically, or services in South Dakota in 200 or more separate transactions.

Since the Wayfair ruling, 45 states with sales and use taxes have enacted or are expected to enact nexus rules similar to those of South Dakota. To find the latest guidance on any particular state’s nexus rules, visit the National Sales Tax Institute. Most states say that you should evaluate your collection obligation if you exceed the economic threshold in the current or prior year. Some states have a quarterly evaluation with a rolling 12-month lookback. Although, it isn’t always clear when the liability begins.

The $100,000 or 200 transactions economic nexus threshold established in the Wayfair case for South Dakota is not a national standard. There have been variations and different interpretations of these thresholds in certain states. For example:

- With respect to the 200-transactions total, some states say that includes all sales, not just taxable sales.

- In states other than Connecticut and New York, the economic threshold nexus test is an “or” test (satisfying one of the two thresholds causes your company to collect and remit sales tax). But in these states, it is an “and” test (you must satisfy both thresholds for your company to be required to collect and remit sales tax in these states).

- The dollar and transaction thresholds vary by state. For example, in Connecticut, the thresholds are sales in excess of $100,000 and 200 transactions. In New York, the thresholds are sales in excess of $500,000 and 100 transactions. And in Minnesota, the thresholds are sales in excess of $100,000 or 200 transactions.

- Note that despite the new economic threshold tests, if you have other nexus creating activities creating a “physical presence” in a state, such as inventory in a warehouse or employees and service people, then you need to collect and remit sales tax.

Remember that sales and use taxes are imposed on the consumer, not on the seller. The seller collects these taxes from the consumer and holds them “in trust” until remittance. The Wayfair ruling does not increase tax liability for sellers, but rather allows states to shift the collection and remittance obligation from the consumer to the seller. And if the seller doesn’t comply with this obligation, guess who pays the sales tax – your company! And the sales-and-use-tax obligations do not necessarily stop at the entity level. Even if you operate as a corporation or limited liability company, the business owners of these entities may find they have personal liability as a result of the “responsible person rules.” Obviously, that is a steep price for non-compliance. Hence, over the last year, there has been a mad rush for retailers to determine whether they meet the new nexus standards established by each state, and if so, to register with those states and start collecting sales tax in those states.

A thorough examination of each state’s sales and use tax laws established post Wayfair is required. While a more detailed discussion of each state’s sales and use tax laws is beyond the scope of this article, if you have a business with out-of-state retail sales, please have a conversation with your accountant or tax advisor.

And, as for myself, my wife is now mentioning that we need a new patio table and umbrella. I’ve heard whispers of a “national sales tax.” Perhaps I should buy that table and umbrella before I have to cough up even more sales tax dollars? Let’s hope my wife is not right this time!